Irs Quarterly Payment Forms 2025. Similar to your regular 1040 tax filing, estimated payments also have a tax payment deadline. In this case, you may need to make a payment with.

Treasury department (treasury) issued regulations finalizing the reporting requirements on the 1% corporate stock buyback tax and starting. Here’s a closer look at how quarterly taxes work and what you.

Quarterly Tax Forms 2025 Ynez Analise, The fastest and easiest way to make an estimated tax payment is to do so electronically using irs direct pay. Access your individual account information to view your balance, make and view payments, view or create payment plans, manage communication preferences, access some tax.

Irs Quarterly Payment Forms 2025 Max Lisbeth, Access your individual account information to view your balance, make and view payments, view or create payment plans, manage communication preferences, access some tax. The estimated tax payment deadlines for individuals in 2025 are as follows:

2025 Form 1120 W Printable Forms Free Online, Similar to your regular 1040 tax filing, estimated payments also have a tax payment deadline. Make a payment today, or schedule a payment, without signing up for an irs online account.

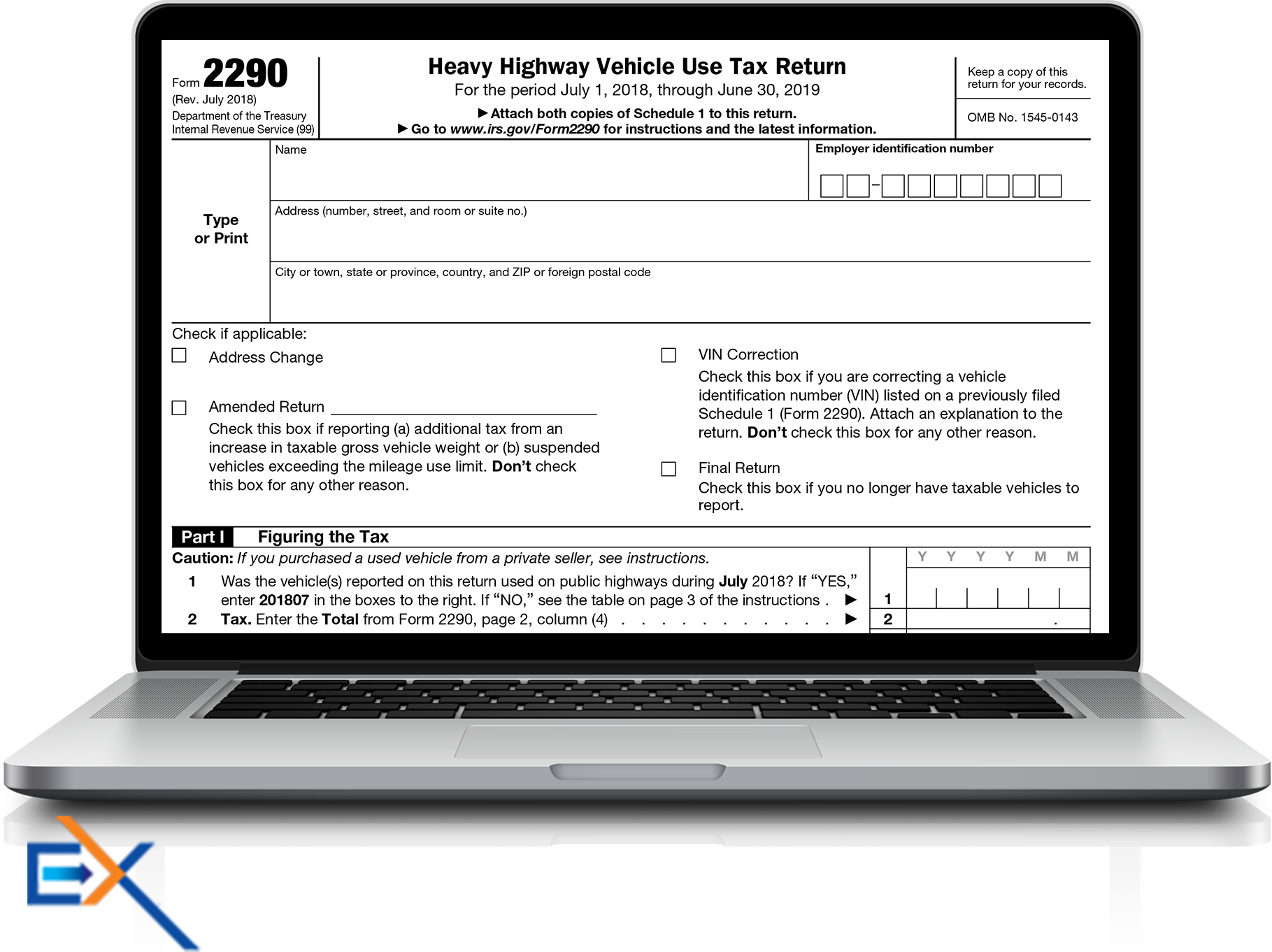

Printable 2290 Form, Use direct pay to securely pay form 1040 series, estimated or other individual taxes directly from your checking or savings account at no cost. Here’s a closer look at how quarterly taxes work and what you.

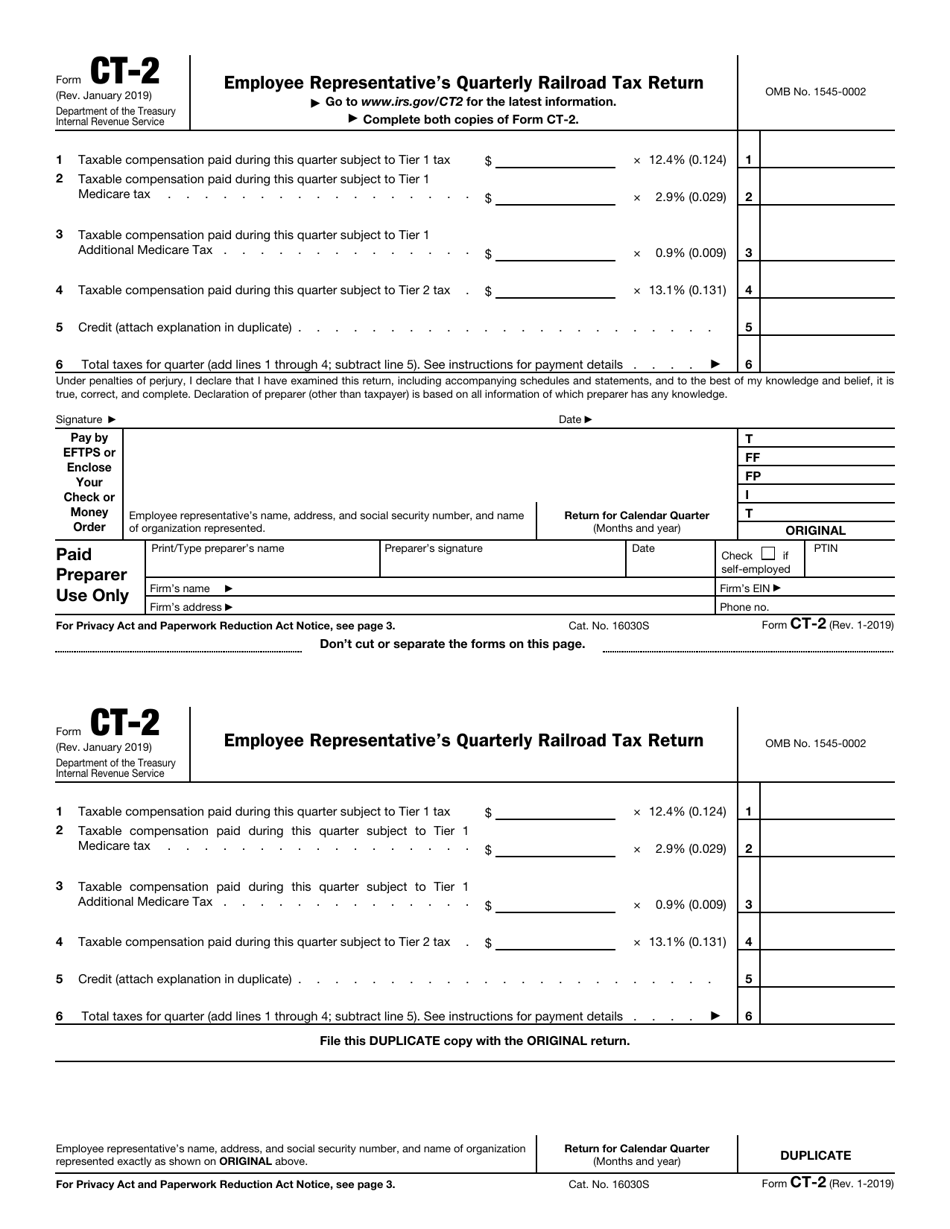

IRS Form CT2 Fill Out, Sign Online and Download Fillable PDF, If you’re an individual, it might not be as. While the 1040 relates to the previous year, the estimated tax.

Irs releases form 1040 for 2025 tax year Artofit, Access your individual account information to view your balance, make and view payments, view or create payment plans, manage communication preferences, access some tax. Here’s a closer look at how quarterly taxes work and what you.

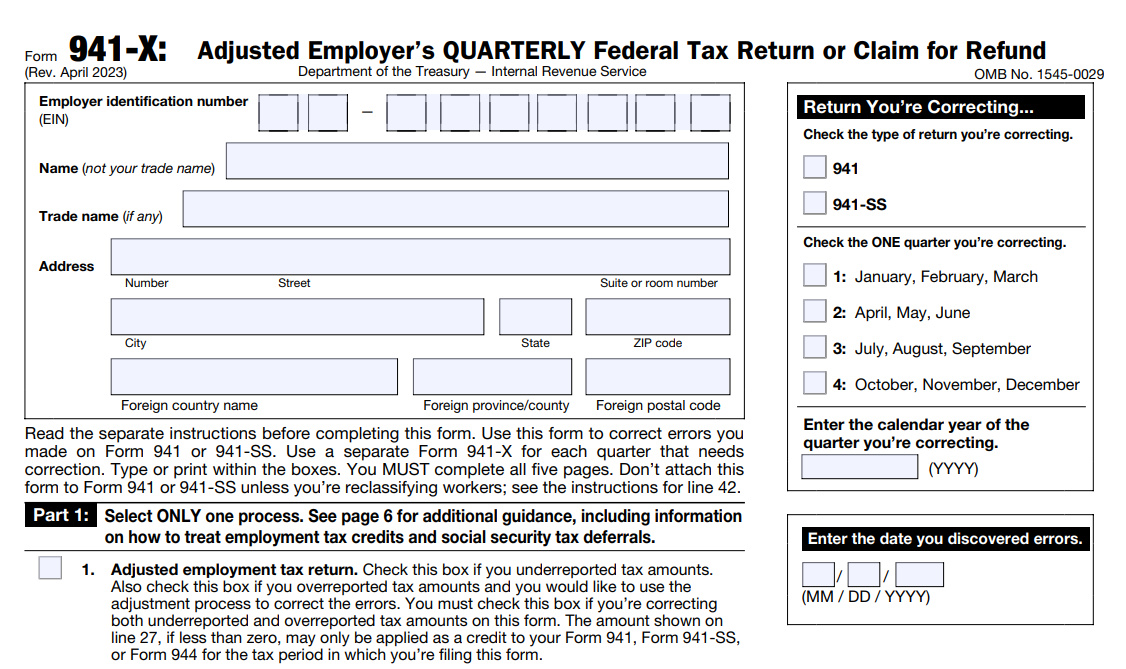

File 941 Online How to EFile 941 Form for 2025, For corporations, it’s a pretty solid bet that estimated taxes will be required. The estimated tax payment deadlines for individuals in 2025 are as follows:

2025 4th Quarter Estimated Tax Payment Gabey Shelia, 3q — september 16, 2025. How to make an estimated tax payment.

State Of Maryland Estimated Tax Payments 2025 ashly lizbeth, When you file your federal income tax return, you may owe a balance due to the internal revenue service (irs). Pay from your bank account, your debit or credit card, or even.

W 4 Forms 2025 Deeyn Evelina, Payments for estimated taxes are due on four different quarterly dates throughout the year. If you’re an individual, it might not be as.